expanded child tax credit build back better

President Joe Bidens Build Back Better plan would extend expanded Child Tax Credit CTC monthly payments through 2022 and make these benefits permanently available to low-income families. When the Build Back Better.

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit

The most recent version of the Build Back Better plan would extend the expanded child tax credits 3000 and 3600 for the 2022 tax year.

. But now the expanded child tax credit has expired since Congress failed to. The Build Back Better Act increases the Child Tax Credit by 1000 to 1600 depending on the childs age. Beyond child care support Build Back Better also includes the permanent expansion of the Child Tax Credit which expired in 2022.

The Build Back Better Act extends the expanded Child Tax Credit as well as the expanded Earned Income Tax Credit and the tax credit to help pay for child and dependent care. While policymakers should ensure that the higher credit is made permanent even if the credit. The expanded CTC represents the biggest investment in American families and children in a generation.

This provision is the main driver of the credit expansions child poverty reductions. The original proposal for Build Back Better included making community college tuition-free for two years something that Biden has advocated for since his time on the campaign trail. The Build Back Better framework will ensure that middle-class families pay no more than 7 percent of their income on child care and will help states expand access to high-quality affordable child.

That increase begins to tail off sharply for couples making over 150000 and is gone by. Over the last 6 months millions of families have received monthly installments of the CTC including 27 million children who were previously excluded from the full tax credit. Voters Are Divided Over One-Year Extension of Expanded Child Tax Credit 47 of voters say the child tax credit should be expanded for a year as prescribed by the Build Back Better Act while 42.

Senate to quickly pass President Joe Bidens and Democrats 17 trillion Build Back Better Act with the. Families received 3000 per child for children from the. Congressman Brian Higgins expressed his support to extend the expanded Child Tax Credit for the next five years through the Build Back Better Act which builds on the success of the American.

Altogether Build Back Betters Child Tax Credit expansions full refundability and expanding the maximum credit to. Once it became clear that President Joe Bidens Build Back. The expanded child tax credit was in place for the last seven months of 2021 after it was passed as part of the American Rescue Plan Act.

Ed Markey and health professionals at Boston Medical Center on Monday urged the US. Last year 44 of adults reported they had skipped at least one medically necessary prescription drug due to cost. Joe Manchin D-WVa has been clear he.

With the expanded child tax credit now languishing the somewhat counterintuitive case has been made that the Republicans should take up the child tax credit mantle. The child tax credit expanded under Bidens COVID-19 relief package the American Rescue Plan. The money in total supported 61 million children.

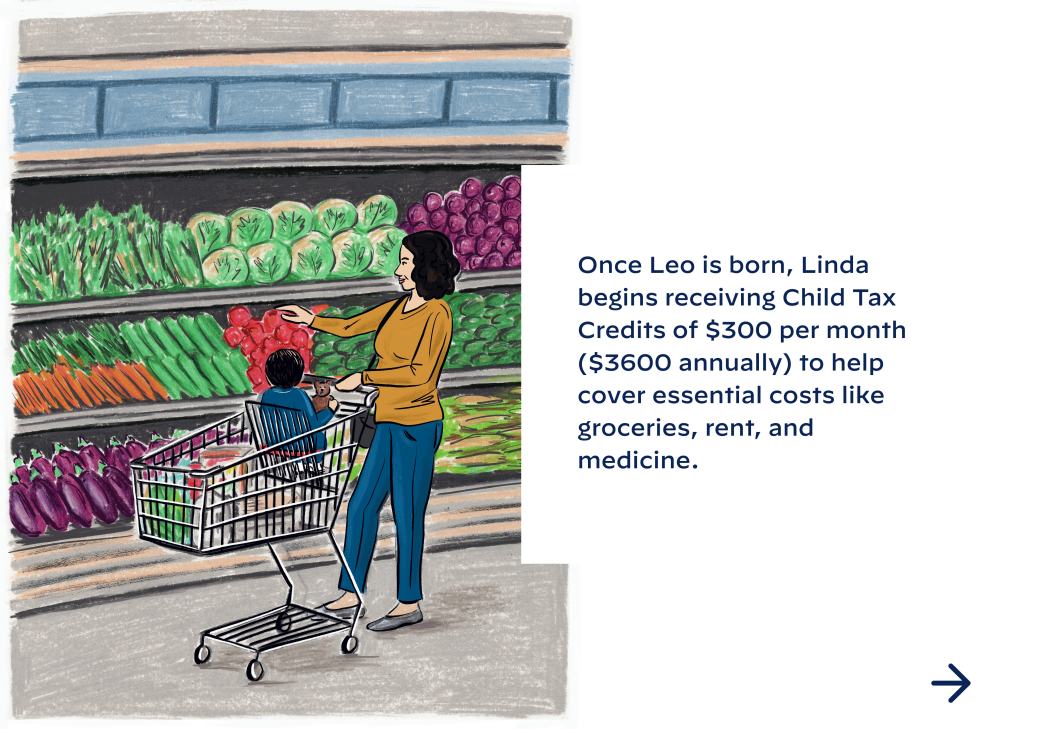

The House-passed Build Back Better Act included a one-year extension of the expanded CTC and permanent full refundability for the credit. Since July of 2021 this provision sent low-income families monthly payments of 300 per child under six years old and 250 for a child under 17 years old. Extending the enhanced child tax credit through Build Back Better would potentially reduce childhood poverty by about 40 according to research from the Center on Budget and Policy Priorities.

The expanded credit which provides 300 per month per child under the age of six and 250 per month per child ages six to 17 was originally part of the American Rescue Plan. For six months in the US families had a monthly cash payment to help cover the costs of raising kids. Twenty20 In a move that could benefit many families House Democrats passed the 175 trillion Build Back Better Act Friday which includes a one-year extension of the enhanced child tax credit.

As the White House continues negotiations on the critical Build Back Better BBB package we respectfully ask you to work to extend the American Rescue Plans ARP expanded Child Tax Credit CTC as a centerpiece of the legislation. The Build Back Better bill is a 17 trillion social safety net that includes investments in climate change health care and child care which includes expanding child tax credit CTC payments.

The Build Back Better Framework The White House

What S Actually In Biden S Build Back Better Bill And How Would It Affect You Us News The Guardian

The Build Back Better Framework The White House

With A Smaller Build Back Better Here S What Aid Americans May Expect

Tax Credit Reforms In Build Back Better Would Benefit A Diverse Group Of Families Itep

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Politifact Sen Manchin Wrong On Income Limits For Child Tax Credit Extension In Build Back Better

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

House Passed 1 7 Trillion Build Back Better Reconciliation Legislation Includes 325 Billion In Green Energy Tax Incentives And More Than 92 Billion In Spending To Address Robust Climate Change Goals Novogradac

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

Expanded Child Tax Credit Has To Be In Final Version Of Build Back Better Act Sen Ed Markey Says Masslive Com

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Fourth Stimulus Check Update Build Back Better Would Send Monthly Payments Through 2022

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep